In the bustling streets of Shanghai's Xintiandi district, a curious transformation is unfolding. Where luxury boutiques once displayed handbags and watches as status symbols, now wellness studios and artisanal tea houses draw crowds of young Chinese consumers. This shift represents more than just changing retail preferences—it signals a fundamental redefinition of fashion itself in the world's second-largest economy.

The era when Chinese consumers used luxury goods primarily as external validation is giving way to a more nuanced approach to consumption. Today's fashion-conscious Chinese are increasingly investing in products and experiences that reflect their personal values and lifestyle aspirations. This evolution from conspicuous consumption to conscious living marks one of the most significant transformations in modern retail history.

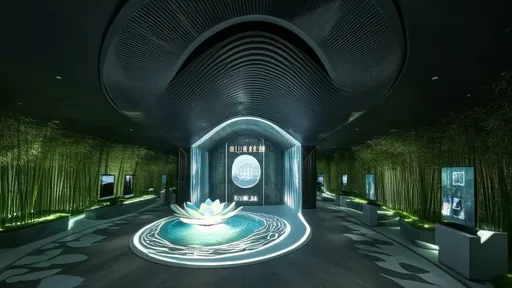

Walking through the recently opened Taikoo Li Qiantan complex in Shanghai reveals this new paradigm in action. The development features meditation spaces alongside fashion retailers, cooking workshops next to designer boutiques, and fitness centers integrated with lifestyle stores. This carefully curated environment reflects how Chinese consumers now view fashion not as separate from their daily lives, but as an integral component of their overall wellbeing and self-expression.

The rise of what industry insiders call "lifestyle fashion" represents a maturation of China's consumer market. After decades of rapid economic growth that created a new class of luxury shoppers, many Chinese consumers are moving beyond the initial thrill of owning expensive items. They're now seeking products that tell a story, experiences that transform their daily routines, and brands that align with their evolving values.

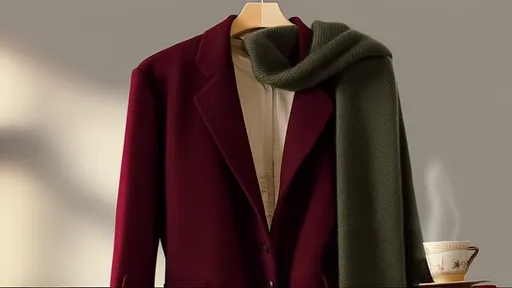

This transition is particularly evident among China's Millennial and Gen Z consumers, who have grown up in an era of relative prosperity and global connectivity. Unlike their parents' generation, who often used luxury goods to signal their arrival in the middle class, younger consumers approach fashion as a form of personal storytelling. They're more likely to mix high-end pieces with local designer finds, prioritize comfort and functionality alongside aesthetics, and choose brands based on their sustainability practices and ethical standards.

The numbers tell a compelling story. According to recent market research, spending on wellness and lifestyle services in China grew by nearly 40% in the past two years, significantly outpacing traditional luxury goods growth. Fitness memberships, organic food subscriptions, mindfulness apps, and experiential travel have become the new status symbols among urban Chinese professionals.

Chinese fashion brands have been quick to adapt to this new reality. Homegrown labels like ICICLE and Exception de Mixmind have built their entire brand philosophy around sustainable living and mindful consumption. ICICLE, for instance, emphasizes natural materials and timeless designs meant to last for years, directly challenging the fast-fashion mentality that once dominated Chinese retail.

International luxury brands are also recalibrating their China strategies. Rather than simply opening more stores with the same product offerings, companies like Louis Vuitton and Dior are creating immersive experiences that blend fashion with art, culture, and dining. Louis Vuitton's recent Shanghai exhibition didn't just showcase handbags—it featured interactive art installations and culinary experiences that positioned the brand as a lifestyle curator rather than just a purveyor of goods.

The digital landscape has played a crucial role in accelerating this transformation. Chinese social media platforms like Xiaohongshu (Little Red Book) have become hubs for lifestyle content, where users share everything from yoga routines and healthy recipes to sustainable fashion tips and cultural experiences. This has created a virtuous cycle where consumers inspire each other to explore new ways of living, and brands respond by developing products and services that cater to these evolving interests.

What makes this shift particularly significant is how it reflects broader changes in Chinese society. As urbanization rates exceed 60% and middle-class incomes continue to rise, many Chinese are grappling with questions about quality of life, personal fulfillment, and environmental responsibility. Fashion and lifestyle choices have become a primary means through which they navigate these complex issues.

The COVID-19 pandemic served as an unexpected catalyst for this transformation. During lockdowns, many Chinese consumers had time to reflect on what truly mattered to them. The pursuit of health, family connections, and personal growth gained prominence over material possessions alone. This mindset has persisted even as normal life has resumed, creating lasting changes in consumption patterns.

Nowhere is this more evident than in the wellness sector. Traditional Chinese medicine principles are experiencing a renaissance among young urbanites, who are incorporating practices like gua sha and acupuncture into their beauty routines. Luxury beauty brands have taken note, developing products that blend Eastern wellness traditions with Western scientific innovation.

The food and beverage industry has similarly evolved to meet these new consumer demands. High-end restaurants now emphasize locally sourced ingredients and traditional cooking methods, while specialty coffee shops double as community spaces for cultural events and workshops. The line between dining, socializing, and fashion has become increasingly blurred.

This holistic approach to consumption represents a significant opportunity for brands that can authentically connect with Chinese consumers' lifestyle aspirations. However, it also presents challenges. Today's Chinese shoppers are more discerning and better informed than ever before. They can detect insincere marketing attempts and will quickly abandon brands that fail to deliver genuine value beyond their products.

The transformation from external display to lifestyle leadership also reflects China's growing cultural confidence. As Chinese designers, chefs, and entrepreneurs gain international recognition, domestic consumers are increasingly proud to support homegrown brands that reflect their cultural heritage while embracing global influences.

Looking ahead, this trend shows no signs of slowing. As China continues its economic development and urban professionals seek greater meaning in their consumption choices, the integration of fashion with broader lifestyle considerations will likely become even more pronounced. The brands that succeed in this new environment will be those that understand they're not just selling products—they're helping Chinese consumers craft their ideal lives.

This evolution from fashion as status symbol to fashion as lifestyle represents more than just a market trend—it's a reflection of China's ongoing social transformation. As Chinese consumers increasingly use their purchasing power to express their values and shape their daily experiences, they're redefining not just what it means to be fashionable, but what it means to live well in modern China.

The implications extend far beyond the fashion industry. This shift toward holistic lifestyle consumption is influencing urban planning, with developers creating mixed-use spaces that blend retail, dining, wellness, and cultural activities. It's changing workplace culture, as companies incorporate wellness programs and design elements that support work-life balance. And it's reshaping how Chinese people think about success and fulfillment in the 21st century.

As the sun sets over Shanghai's Huangpu River, the city's skyline tells the story of China's consumer evolution. The flashing logos of luxury brands now share space with yoga studios, organic markets, and cultural centers. This new urban landscape reflects a fundamental truth about contemporary Chinese society: that personal style is no longer just about what you wear, but about how you live.

By /Oct 23, 2025

By Michael Brown/Oct 23, 2025

By /Oct 23, 2025

By /Oct 23, 2025

By /Oct 23, 2025

By /Oct 23, 2025

By /Oct 23, 2025

By /Oct 23, 2025

By Samuel Cooper/Oct 23, 2025

By /Oct 23, 2025

By /Oct 23, 2025

By /Oct 23, 2025

By /Oct 23, 2025

By /Oct 23, 2025

By Daniel Scott/Oct 23, 2025

By /Oct 23, 2025

By /Oct 23, 2025

By /Oct 23, 2025

By /Oct 23, 2025

By /Oct 23, 2025